Recent studies show that 75% of small businesses are underinsured, leading to unforeseen risks and potential financial disasters.

With these staggering statistics, it’s crucial to understand how much product liability insurance your business should carry.

Understanding Product Liability Insurance

What Is Product Liability Insurance?

In the bustling world of eCommerce, crafting the perfect product is a labor of love – a blend of passion and hard work. However, even the most meticulous eCom sellers face risks.

Imagine, for a moment, that a product you’ve meticulously designed causes unintentional harm to a customer or their property. The implications aren’t just about the direct harm: they span legal ramifications, unexpected bills, and potential brand tarnishing. These headaches can arise unpredictably, even if a customer simply misuses your product.

The weight of potential lawsuits, medical bills, and damages can be daunting. For the unprepared business, this weight can morph into an existential threat, overshadowing achievements with looming uncertainties.

But there’s a shield available for these very predicaments: Product Liability Insurance. It offers a robust defense against the unforeseen, covering everything from property damages to legal fees.

Navigating eCommerce’s challenges requires more than just a stellar product – it demands foresight and protection.

As you journey through this space, arm your business with the right liability coverage, tailored to your unique needs, ensuring that you’re shielded from any potential legal storms.

Why You Need Product Liability Insurance

Product liability insurance isn’t just another checkbox on your business checklist – it’s an essential safety net.

Regardless of your role in the product journey – creator, manufacturer, or distributor, this insurance protects you from the potential financial fallout of unforeseen product issues.

It’s an unpredictable eCommerce landscape out there. From manufacturing flaws to shipping mishaps, the blame can quickly shift to you. But ensuring your business’s financial security against these unforeseen pitfalls doesn’t have to be complicated.

Explore the importance of product liability insurance with McDonald’s $3 million hot coffee lawsuit.

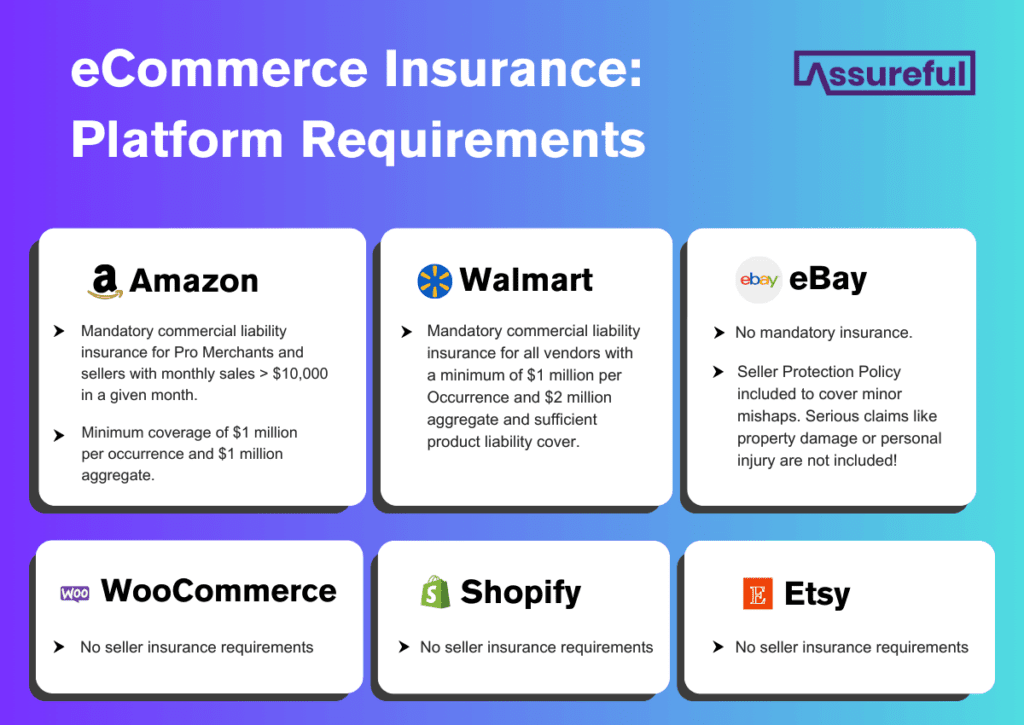

eCommerce Platform Liability Requirements

Now, how much product liability you get, will likely depend on which eCommerce platform you are using and the perceived risk of the product. Let’s go through some of the top platforms and their requirements:

Note: The below requirements are correct in the US as of 14th August 2023

Amazon Liability Insurance Requirements

For every eCommerce enthusiast making waves on Amazon, hitting that enviable $10,000 mark in a month as a Pro Merchant or seller is more than just a milestone – it’s a testament to hard work and strategy.

But success on this scale comes with its own set of responsibilities. Let’s dive straight into what this means for you.

Upon touching that $10,000 threshold, you have a sharp 30 days to secure commercial liability insurance. As described in the Amazon Business Solutions Agreement your coverage should meet a minimum of $1 million per occurrence and also an aggregate limit of $1 million.

No obligation quote.

Policies can be canceled at any time, with 30 days’ notice.

Walmart Liability Insurance Requirements

At its core, Walmart’s intention is straightforward: ensuring that every supplier has a safety net. This isn’t just a mandate – it’s Walmart’s way of ensuring you’re equipped against unforeseen challenges.

The kind of safety net you’ll need to sell on Walmart starts at a minimum of $1 million per Occurrence and $2 million aggregate.

And remember: insurance isn’t just a piece of paper—it’s your business’s armor. Be wise, be protected, and let’s chase success together.

eBay Liability Insurance Requirements

eBay does not mandate its sellers to carry any particular insurance.

Yes, that’s right: no specific liability insurance requirements in sight. But, that doesn’t mean you should break easy just yet.

If you’re dealing in products with even a hint of potential harm (which is pretty much any physical product ever sold), we still highly recommend you protect your business by carrying the right eCommerce liability insurance.

Why? Because it’s your financial armor against potential lawsuits or claims linked to any property damage, injuries, or other harms caused by what you’re selling.

eBay does have your back in some respects with their Seller Protection Policy. This is their way of safeguarding sellers from hiccups they term as “outside your control.” Some of these ‘hiccups’ include:

- An item arrives late that you shipped on time

- A buyer retracts their bid or doesn’t pay

- A buyer changes their order or requests something extra

For an exhaustive list and in-depth details, be sure to read through their Seller Protection Policy.

As you can see, this protection policy doesn’t cover you for anything too serious, with their User Agreement stating:

“In addition, to the extent permitted by applicable law, in no event will eBay (including our parent, subsidiaries, and affiliates, and our and their officers, directors, agents, and employees) be liable to you or any third party under any claim at law or in equity for any consequential damages or losses (including, but not limited to, loss of money, goodwill or reputation, profits, other intangible losses, or any special, indirect, or consequential damages), and all such damages or losses are expressly excluded by this agreement whether or not they were foreseeable or eBay was advised of such damages or losses.”

So, While eBay provides a degree of cover, remember: your business’s security is ultimately in your hands.

This is why we recommend taking out a liability insurance policy regardless of where you conduct your eCommerce business.

Sign up today to receive your quote in minutes.

No obligation quote.

Policies can be canceled at any time, with 30 days’ notice.

Etsy Liability Insurance Requirements

In the realm of Etsy, the rulebook might surprise you: there’s zero mandate for sellers to be insured.

But, remember: it’s in your best interest to insure your eCommerce business.

Product liability insurance isn’t just a fancy term – it’s your silent business partner. It stands by you, protecting you from potential financial setbacks arising from accidents or injuries tied to what you sell. While Etsy doesn’t push for it, this insurance is your backup plan, your security blanket.

Shopify Liability Insurance Requirements

Shopify, similar to Etsy and eBay, does not require its sellers to take out any insurance.

While Shopify, the giant in the eCommerce universe, doesn’t outright demand you arm yourself with insurance, it’s crucial to have that added layer of defense in the event things go wrong.

Just because your store is online doesn’t mean you’re invincible. If you’re shipping out physical products to your customers, then listen up: the world of product liability is one you don’t want to overlook.

WooCommerce Liability Insurance Requirements

WooCommerce doesn’t lay down a playbook for liability insurance. But, just because there’s no rulebook doesn’t mean you shouldn’t play along.

Navigating the digital marketplace isn’t just about dazzling aesthetics or killer plugins. It’s about preempting those “uh-oh” moments. It’s not just about covering unforeseen costs, it’s about safeguarding your brand’s reputation.

Note: The above requirements are correct in the US as of 14th August 2023

Amazon Liability Insurance Requirements

Amazon accepts both claims-made and occurrence policy types in some instances, but Amazon specifies that claims-made policyholders must obtain a 3-year tail coverage. Read our full article on Claims-Made vs Occurrence for more details.

How much product liability insurance does Assureful recommend?

Product liability insurance is no one-size-fits-all and the amount of coverage we recommend is dependent on the type of products you’re selling, their perceived risk level, and via which platforms you’re selling them.

Get an instant free quote today for the most accurate and fairly priced insurance to fit your eCommerce needs.

Find out how much liability insurance you need.

No obligation quote.

Policies can be canceled at any time, with 30 days’ notice.

0 Comments