Insurance premium audit. An annual necessary evil to ensure your insurance coverage meets your actual needs.

In this blog post, we’ll guide you through the audit process and how it can help you manage your insurance expenses effectively – or read until the end for how you can avoid painful premium audits altogether.

What is an Insurance Premium Audit?

An insurance premium audit is a review conducted by your insurance company at the end of your policy period and when you cancel your policy. The goal is to ensure that your coverage for the previous period matches the level your company actually needed during the policy term.

When you first purchase a business insurance policy, traditional insurers will base your premium on estimated exposures, using data like projected payroll and sales.

However, as your business evolves, these estimates usually don’t accurately reflect your actual operations. That’s where the premium audit comes in. It gives you and your insurance provider an opportunity to reevaluate and adjust your premium based on your actual performance and risk exposure so that your policy can be adjusted.

The Premium Audit Process

The premium audit process may seem daunting, and without the right preparation, it can be. Nowadays, most audits can be entirely completed online, though some states and insurance companies may still require someone onsite to perform the audit in person – another obstacle facing eCommerce businesses who, more often than not, work remotely.

When it comes to your premium audit, your insurance provider will contact you directly and an auditor will provide a list of documentation they need to review your business.

The audit process is a comparison of your initial estimates versus your actual business operations to prevent over- or under-insurance going forward. But this annual forecasting method isn’t without its flaws (more on that later).

In most cases, this will all be completed and reported to your insurance company within 30 days.

Preparing for a Premium Audit

Preparation is key to a smooth premium audit process and there are three key things you can do ahead of time:

- Know when your audit will be due: You can’t prepare if you lose track of when your policy expires and therefore when your premium audit will be due.

- Keep Your Documents Organized: The auditor will likely need to see a variety of documents, including:

- Payroll records

- Cash expenses

- Overtime pay records

- General company ledger

- Company federal tax return forms

- Description of your company’s services

- Job duties and employee classification codes

- Certificates of insurance for all subcontractors

- W-2 and 1099 forms for all employees and contractors

- Choose the Right Company Representative: The person handling the audit inhouse and liaising with the auditor should be knowledgeable about your business operations and able to answer the auditor’s questions accurately.

Remember, accurate record-keeping is essential not only for the audit but also for the overall management of your business.

Daunted by the prospect of a looming premium audit? At Assureful, we designed our eCommerce liability insurance policies to cut out the stress – with accurately rated, monthly billed insurance based on actual sales.

Impact of Premium Audits on Insurance Adjustments

The impact of the audit findings on your insurance policy premiums can be huge. Your insurance company will use the information to make adjustments to your premium from the previous policy period.

Here are some scenarios that could lead to premium adjustments:

- Underpayment: If your actual business operations outpace your initial estimates, you might have underpaid for coverage. In this case, you’ll have to make up the difference or leave your business at risk. Your insurance provider will let you know how soon you need to pay your additional premium.

- Overpayment: On the other hand, if your actual operations don’t live up to your estimates, you might have overpaid. In this case, most insurance providers won’t offer a refund (a scenario our Co-Founder Rohit experienced himself).

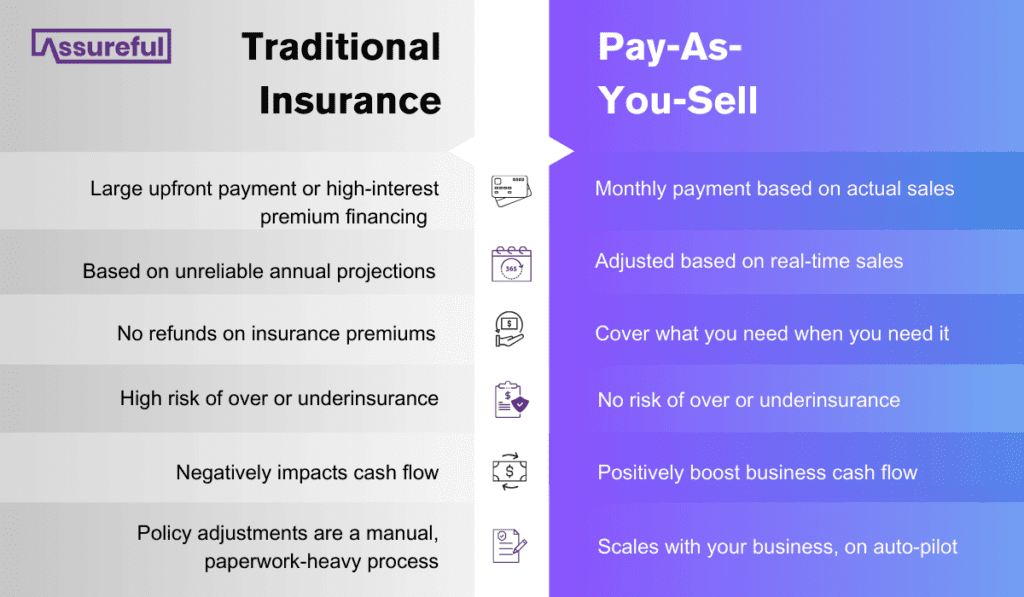

At Assureful, we understand that these adjustments can be a financial burden, especially for small businesses. That’s why we offer pay-as-you-sell insurance, which adjusts your premium based on your actual sales every month so you’re never left with any costly surprises.

After the Audit: Review and Adjustments

After the auditor has reviewed your documents and assessed your business operations, they’ll report the audit results back to your insurance provider. This report will include a detailed analysis of your actual exposures during the policy period, compared to your initial estimates.

One key document you’ll receive is the Statement of Premium Adjustment. This document outlines the changes in your premium based on the audit findings. It’s important to review this statement carefully to address any discrepancies and understand the adjustments made to your premium.

Ensure you understand how the audit findings have affected your premium. If you’re unsure, don’t hesitate to ask questions. Remember, it’s important to fully understand your insurance policy and how your premium is calculated. If you find any discrepancies or have any concerns, always discuss them with the auditor. They can provide clarifications and, if necessary, make corrections.

If you owe an additional premium, your insurance provider will inform you how and when to make the payment. If you’ve overpaid, they’ll explain how you’ll receive your refund or credit if they offer one.

How Do I Avoid a Premium Audit?

Insurance premium audits used to be an essential part of the business insurance process. They ensured that your premium accurately reflected your business’s actual operations, protecting both you and your insurance company.

While traditional insurance providers often still use this model, it doesn’t reflect the dynamic nature and fluctuations of the eCommerce business model.

Assureful’s pay-as-you-sell insurance is designed specifically for those eCommerce sellers frustrated with inaccurate yearly forecasts and premium audits. Our platform connects directly to all major selling platforms – like Amazon and Walmart – to adjust based on real-time sales data every single month. So stressful premium audits are a thing of the past.

Ready to avoid your next premium audit? Swap to Assureful today for the most accurately and fairly priced eCommerce general liability insurance, starting from just $26 a month.

No obligation quote.

Policies can be canceled at any time, with 30 days’ notice.

0 Comments