We get it. In a world where personal data is your most valuable commodity, it’s natural to hesitate before connecting your eCommerce seller account just to get an insurance quote.

But here’s the thing:

At Assureful, we’re not just about providing insurance. We’re about providing the right insurance, tailored to your specific needs as an eCommerce seller.

And to do that, we need a little insight into your business.

In this blog post, we’ll explain what we do with your data, show you how this connection helps us get you the best possible quote, and walk you through the simple process of connecting your seller account.

How Does Connecting My Seller Account Get Me the Best Quote?

Once your seller account is connected, that’s when the magic starts to happen.

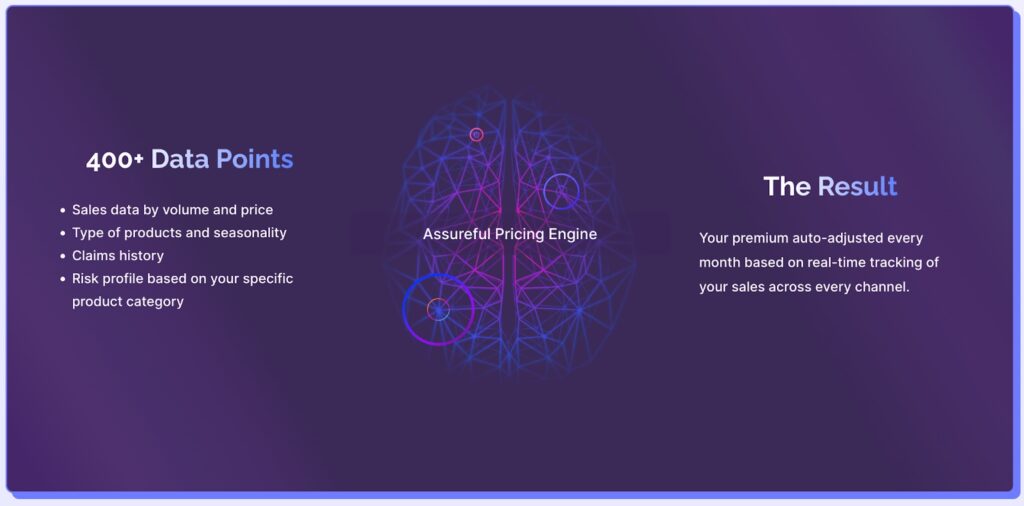

Our proprietary machine-learning pricing engine analyzes over 400 data points to determine the risk and exposure of each of your products individually.

This includes your sales data by volume and price, the type of products you sell, seasonality, claims history, and risk profile based on your specific product category – all determined at the product SKU level to derive the most accurate quote.

You might be wondering, what do we mean by risk and exposure? At the most basic level:

- Risk: This is what we classify as the likelihood that your product is going to harm the end user or their property. If you sell a baby product, for example, the level of risk is higher than selling a book. Our rating engine monitors and collects sales data in real-time from eCommerce marketplaces across 28,000 product categories and uses this to assess the level of risk.

- Exposure: This is based on the quantity of products that you sell. Quite simply, the more products you sell, the more exposure you have. From a probability standpoint, let’s say you have a 0.01% chance of your products causing property or bodily harm, it’s more likely this is going to occur if you sell 1 million products, compared to only 10,000 products.

However, risk and exposure are very nuanced when it comes to pricing your insurance. Typically, as your business grows, your premium price per revenue tends to decrease as you sell more.

So, by connecting your seller account, we’re able to automatically gather the data we need to accurately assess your risk and exposure, ensuring you get the most accurate and competitive price, without mountains of paperwork.

What We Do With Your Data

At Assureful, we take your privacy seriously. We abide by all laws and regulations related to data protection and privacy, including maintaining SOC 2 compliance. We use your business data to enhance the service we offer and ensure that our rating of your business is accurate so you receive the best possible price.

You can read more about our commitment to privacy in our Privacy Policy.

So, now that we’ve assured you that your data protection is our top priority, let’s delve into how we use this data to deliver you the most accurate and fairly priced general liability insurance for your eCommerce business.

But I Don’t Need to Connect My Account to Get a Quote from a Traditional Insurance Provider

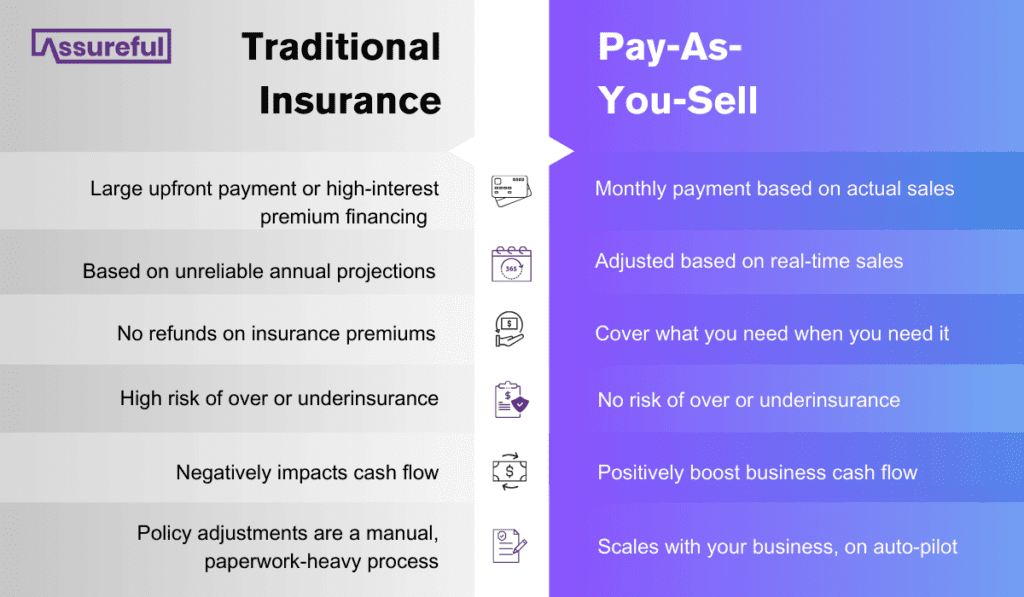

With most advances in innovation, there’s always an ‘old’ way of doing things that gets left behind, and for good reason.

Think VHS to DVDs, Blockbuster to Netflix. The same applies to online seller insurance.

Traditional insurers are great at quoting premiums for brick-and-mortar stores – that’s what they’ve done for so long. Online stores, not so much.

Securing liability insurance from a traditional provider often requires you to generate unreliable projections and estimations of your annual revenue. If you get this wrong, you could be left over- or underinsured.

Our founder, Rohit, experienced this firsthand when he over-projected his revenue and overpaid for his insurance. And as you may have guessed, he wasn’t permitted a refund. This experience is what inspired him to start Assureful and create a better way.

Moreover, time-consuming and costly insurance premium audits are commonplace to ensure your projections are accurate – with even more paperwork to add to your plate.

All of this could be avoided by taking a few minutes to connect your seller account and letting our rating engine take care of the rest.

A direct connection to your seller account is also what allows us to assess every single product at the SKU level, instead of broad categories that could lead to higher premiums if your product is inaccurately categorized. You can read more about this in our article on hidden product risks.

So How Do I Connect My Seller Account to Assureful?

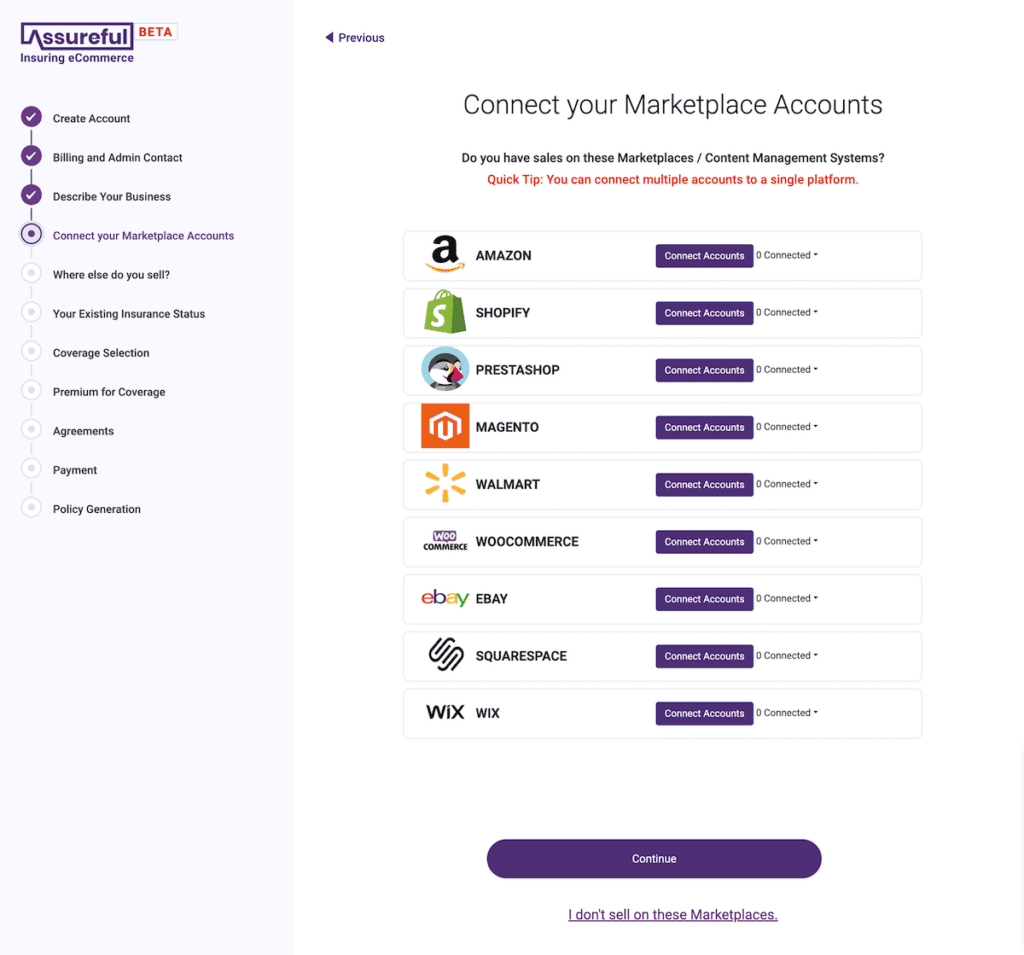

Connecting your seller account to our platform is a breeze.

It should only take 15 to 30 seconds per store that you want to connect. To make the sign-up process as seamless as possible, we recommend having some information at hand before starting:

- Your business details, including name, address, and incorporation date (don’t worry if you don’t know the exact date. Just answer to the best of your knowledge)

- The login credentials for all the marketplaces you currently sell on

- Some basic details regarding any existing insurance policies and what kind of coverage you’re looking for

Ready to get started? Here’s how:

- Hit ‘Get A Quote‘ below

- Begin by creating an account

- Answer basic questions about your business

- Connect the marketplaces that you currently sell on. Simply click the “Connect Account” button for each applicable platform and you’ll be prompted to log into your seller account through a secure portal.

- Continue through the sign-up form to provide us with more information about anywhere else you sell, your existing insurance status, and coverage requirements.

And that’s it! We’ll get back to you in no time with your insurance premium quote.

Can I Disconnect my Marketplace Integrations?

Absolutely! You can revoke access or disable the application at any time, depending on the store that you have connected to our platform. However, this will affect your insurance coverage and may leave your business unprotected.

What Are the Ongoing Advantages of Integrating My Seller Account?

Our pay-as-you-sell insurance model offers numerous benefits over most traditional insurance providers.

By connecting your seller account to our platform, you can take full advantage of these benefits:

- Monthly payments based on actual sales, not projections: Had an amazing Black Friday sale and your sales skyrocketed way past your projections? Or has your seller account been wrongly suspended for a while, impacting sales? Don’t worry about it. Your premium is updated in real-time, month by month, to reflect the peaks and troughs your eCommerce will naturally go through.

- Adding and removing products? No need to let us know. As your seller account is integrated with our pricing engine, we automatically detect these changes and update your premium accordingly the following month.

- No upfront insurance premiums or high-interest premium financing: Improve your cash flow with no interest and no large upfront payments. Get your insurance for as low as $26 a month.

Avoid the dreaded premium audits: Read more about this in our premium audits blog post.

Ready to Automate Your Liability Insurance?

Sign up today to connect your seller accounts in minutes and get your free eCommerce insurance quote.

No obligation quote.

Policies can be canceled at any time, with 30 days’ notice.

0 Comments