Would you know where to start if your eCommerce business was hit with a product liability claim?

Panic or stress shouldn’t be your first port of call. Of course, your insurance provider should be.

Here are five tips you should know about when it comes to dealing with a general liability insurance claim.

But first: Understanding General Liability Insurance

At the heart of a robust business defense lies General Liability Insurance – a shield against the slings and arrows that modern commerce can throw your way. Also known as Commercial General Liability Insurance, this coverage is not just important — it’s essential.

General Liability Insurance or Commercial General Liability Insurance is the basic level of coverage we recommend every eCommerce business owner take out to shield their business from potential claims.

Types of incidents covered under general liability insurance are as varied as the businesses it protects. From customer injuries to property damage caused by your products, this insurance is designed to cover the unforeseen. Some providers will also offer coverage for additional risks like copyright infringement or reputational damage.

In the following sections, we’ll guide you through the five steps you should be aware of in the claim process, from gathering the initial information to managing your records throughout.

Tip #1: Gather The Essential Information

Before contacting your insurance provider, you’ll need a checklist of all the essential information and documentation about the incident and your insurance policy. Here’s what you should have at the ready:

- Your name

- Current contact info

- Business name

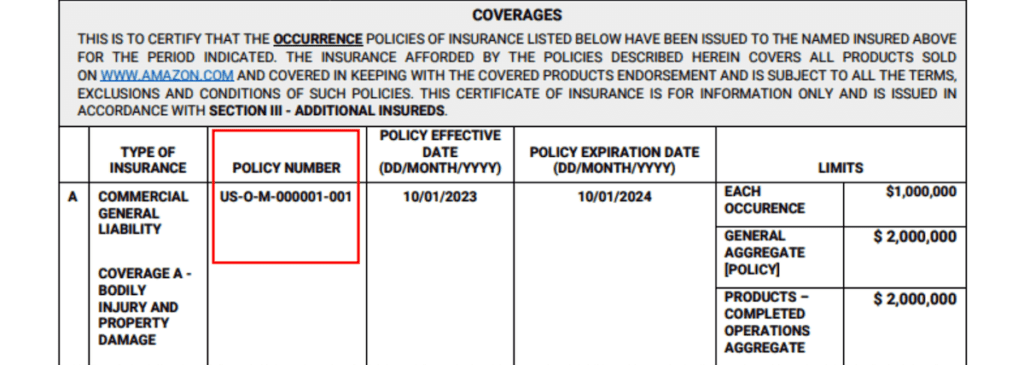

- Policy number

- Description of the claim

For Assureful customers: Your policy number can be found here on your COI:

Our best advice here is to be thorough when gathering the information about the claim made against you. Collect witness information, take photographs, and jot down every detail, even if it seems irrelevant.

This is the information that will guide your claim to a successful resolution.

Tip #2: Immediately Contact Your Insurance Provider

When a claim is made against your business, time is of the essence.

Even if there hasn’t been any mention of legal matters yet – it’s always recommended to give advanced notice to your insurer and legal counsel as a proactive measure.

Delaying contact could result in a sluggish claim process, and that’s the last thing you want.

If you’re an Assureful customer, reaching out is as simple as contacting our customer service team by completing a contact form. We’re here to support you through each subsequent step, ensuring that your claim is handled with the utmost care and efficiency.

Tip #3: Get Clear on Your Policy

Once you’ve initiated contact with your insurance provider, it’s also recommended to make sure you understand the specifics of your insurance policy – so you’re prepared to move forward.

When reviewing your policy, pay close attention to:

- Policy limits: Know the maximum amount your policy will pay out per occurrence and in the aggregate

- Deductibles: Be clear on what you’re responsible for paying out-of-pocket so you can start setting this money aside, if you haven’t already done so

- Exclusions: Understand what is not covered under your policy to avoid surprises when it comes to settling the claim

Armed with this knowledge, you’re ready to ask your Insurance Agent the right questions.

Here’s a list to guide your conversation:

- What are the time limits for reporting an incident or filing a claim?

- Is the specific incident covered under my policy?

- Could you walk me through the next step of the claim process for my particular situation?

- What further documentation will I need to provide?

- How will this claim affect my future premiums?

Remember, no question is too small when it comes to understanding your coverage. It’s better to ask early on than to get blindsided later.

For Assureful customers facing a claim: if you’re feeling overwhelmed or unsure whether your policy protects you against the incident, our customer service team is on hand to answer all of the questions above and alleviate any concerns.

Tip #4: Keep Diligent Records From Start to Finish

As you progress through the claim process, maintaining meticulous records is absolutely recommended.

Here’s the kind of records you should be documenting:

- All communications: Keep a log of every phone call, email, and face-to-face conversation related to your claim

- Claim developments: Note down each update or change in the status of your claim

- Expenses: Track any costs you incur due to the claim, including legal expenses

This diligent record-keeping serves as a chronological account of the entire process, which can be invaluable – especially if the claim escalates to a lawsuit. It’s the proof you need to back up your position and the narrative of how events have unfolded.

In the event of a lawsuit, this clear account of your actions can often be the deciding factor in the resolution of a claim. So, keep your logbook detailed and up-to-date from the day the incident is raised.

Tip #5: Thoroughly Assess Your Options When Resolving the Claim

Let’s consider some options that you may face when resolving a claim:

Responding to the Claim: Much like choosing the right approach in a negotiation, deciding whether to admit or deny the allegations is pivotal. Your response should be carefully crafted, reflecting the strength of your position and the evidence at hand.

Seeking Dismissal: If the claim is unfounded, seeking dismissal may be on the table. It’s an assertion that the claim lacks legal standing, and with the right documentation, could lead to a quick resolution.

Considering Settlement: At times, the path of least resistance is the most strategic. A settlement can be a mutually beneficial resolution, avoiding a court battle and the reputational damage that may follow.

Each option should be weighed based on the facts of your claim. We at Assureful deal with every aspect of the claim and claim-handling process. Once you tell us about a claim, we take care of everything else including decision making, legal expenses etc., ensuring that the resolution of your claim aligns with the best interests of your business and the limitations of your insurance coverage.

How to Make a Claim as an Assureful Customer

We encourage you to stay prepared, stay informed, and remember that with the right partner, even the most daunting of claims can be navigated with confidence and ease. We’ve made the process as straightforward for our customers as possible.

Here’s how to initiate a claim with Assureful:

- Notify Us: Complete a contact form to inform us that a claim has been made.

- Provide Details: You’ll be prompted to share some basic information about the claim.

- We Handle the Rest: From there, our team will manage everything, keeping you informed and supported every step of the way.

Not an Assureful customer? We provide ‘A’-rated liability insurance, designed specifically for eCommerce. So you can sell with confidence.

No obligation quote.

Policies can be canceled at any time, with 30 days’ notice.

0 Comments