Navigating product liability in the digital world is like walking through a maze with hidden traps. Just when businesses think they’ve mastered the path, a new challenge emerges.

This article compares the traditional brick-and-mortar approach to product liability with the intricate and often surprising complexities found in eCommerce, offering insights and guidance for navigating this evolving landscape.

Understanding Product Liability in eCommerce

When it comes to eCommerce, the concept of product liability takes on a new dimension, bringing with it a host of unique challenges. Unlike traditional brick-and-mortar retail, where consumers can physically inspect products before purchase, online sales introduce a set of complexities that demand careful consideration.

Below, we delve into how the principles of product liability extend into the realm of eCommerce and explore the challenges it presents.

Quality control in a virtual marketplace

Online platforms like Amazon and eBay host an array of products from various sellers, making product consistency and safety challenging.

Consumers trust that what they see on their screens accurately represents the product they will receive, making quality control a key concern.

Cross-border transactions

In eCommerce, there are no borders, making international transactions commonplace. While this global reach offers increased opportunities for savvy eCommerce business owners, it also complicates matters when it comes to product liability.

Different countries have varying regulations and standards, and it can be challenging to constantly be aware of this complex web of international laws. This makes understanding the legal implications of cross-border sales essential for businesses engaging in eCommerce at a global scale.

The proliferation of third-party sellers

The fact that online marketplaces host thousands of third-party sellers, can further blur the lines of responsibility in product liability cases.

When a product purchased on a platform like Amazon, Ebay, or Etsy turns out to be defective or harmful, determining who bears the liability can be difficult.

Is it the original manufacturer, the third-party seller, or the platform itself? This ambiguity underscores the importance of protecting yourself as a third-party seller, in the case that the responsibility falls squarely on your shoulders.

Being successful in the digital marketplace requires a full grasp of the legal implications in the event of a product liability claim to ensure safety, fairness, and accountability for all stakeholders.

Famous Product Liability Cases and Incidents in eCommerce

From malfunctioning electronics to recalled products resurfacing online, the following product liability lawsuit examples highlight the importance of comprehensive general liability insurance.

1. Amazon’s legal battle over exploding hoverboards

The 2018 Amazon exploding hoverboard case brought to the forefront intricate product liability challenges within eCommerce. Hoverboards, notorious for overheating and fires, resulted in lawsuits against Amazon, which was hosting numerous third-party sellers of these products.

Amazon’s defense centered on its role as a marketplace, not a direct seller, emphasizing the primary responsibility of sellers for product safety.

There were numerous incidents of hoverboards sold on the platform spontaneously catching fire, due to overheating and battery packs exploding. These Back to the Future-inspired gadgets (or modes of transport) were being sold via Amazon between 2015 and 2016 (costing as much as $900 each). Due to the number of incidents that resulted in burns and damaged property, more than 500,000 hoverboards were recalled.

The court ruling favored Amazon, underlining the critical role of third-party sellers in ensuring the safety of their own products. While this precedent had significant implications for eCommerce liability, it also raised concerns about consumer protection and compensation, especially when dealing with international or financially unstable sellers.

2. Counterfeit cosmetics product liability cases

Product liability cases such as a lawsuit by Benefit against counterfeiters, highlight the dangers of fake beauty products in eCommerce.

Counterfeit cosmetics not only infringe on brand rights but also pose health risks to buyers due to substandard ingredients. As a result, online sellers are responsible for inadvertently or knowingly selling counterfeit cosmetics, potentially facing legal repercussions and damaging their reputation.

Benefit Cosmetics, the San Francisco-based makeup brand, took a group of counterfeiters to court in 2019 over the sale of fake cosmetics, alleging that they were selling fake products online and infringing the brand’s trademarks.

Benefit stated at the time:

“Tactics used by defendants to conceal their identities and the full scope of their counterfeiting operation make it virtually impossible for Benefit to learn defendants’ true identities and the exact interworking of their counterfeit network.”

Tommy Hilfiger filed identical lawsuits against counterfeiters around the same time. And in 2020, Amazon and KF Beauty jointly filed a lawsuit against four companies and 16 individuals.

Having robust product liability insurance is pivotal for online sellers to mitigate financial risks associated with cosmetic sales to cover legal expenses, settlements, and other costs arising from product liability claims.

As the beauty industry grapples with counterfeiting, online sellers should recognize insurance’s crucial role in protecting their business and consumer safety.

3. Recalled products and imported goods posing significant health risks

Instances of recalled products resurfacing online, such as the alarming case of a fingerprint dusting kit contaminated with asbestos, underscore the need for comprehensive insurance solutions.

In this 2015 case, reports emerged about asbestos found in crayons and crime scene fingerprint kits. The products had been imported from China, which remains one of the biggest users of asbestos, despite the health risks of the substance. The products were recalled and tested by the Scientific Analytical Institute in North Carolina.

When selling products online that are imported from other countries, like China, it’s important to understand the risks, especially when other jurisdictions have different rules and thresholds for health and safety.

In terms of recalled products being resold, this is strictly forbidden and can incur eye-watering fines and serious ramifications. Famously:

- Home Depot agreed to pay a $5.7 million civil penalty in 2017 for selling and distributing previously recalled consumer products

- In 2016, Best Buy paid a $3.8 million fine for selling 600 recalled items, including more than 400 Canon cameras, to consumers and implemented a compliance program for the appropriate disposal of recalled products

Recalled products resurfacing in online marketplaces pose serious dangers to consumers and expose your business to financial and reputational risks.

This is an example of where insurance is a vital safeguard for businesses handling recalled items. It offers crucial protection against legal repercussions, financial liabilities, and reputation damage, even when dealing with previously recalled products.

Additionally, insurance providers play a key role in guiding businesses toward effective risk management strategies, ensuring they don’t unwittingly reintroduce hazardous products into the market.

Steps Amazon Has Taken Concerning Defective Electronics Sold on Its Platform

Cases involving malfunctioning electronics serve to remind us of how important insurance is in protecting businesses from potential legal liabilities.

For instance, Amazon has taken steps to compensate consumers for defective products sold on its marketplace in response to mounting concerns over malfunctioning electronics and other below-standard products. Instances, where consumers have experienced damage, injury, or financial loss due to these faulty electronics, have led to legal actions against both Amazon and third-party sellers.

Comprehensive product liability insurance can offer protection by covering legal expenses, settlements, and potential damages. Having the right level of insurance coverage is a proactive measure to mitigate potential legal liabilities and ensure consumer satisfaction.

Find out everything you need to know about Amazon product liability insurance in our handy Guide to Amazon Seller Insurance Requirements.

Learning From eCommerce Cases: Insights and Prevention

The cases outlined above underscore the vital importance of comprehensive insurance solutions. Beyond insurance, proactive measures are essential for product safety and establishing trust with customers.

Here are key lessons from these cases:

Vetting your suppliers

Thorough evaluations of your suppliers serve as a critical foundation for effective risk management. These assessments empower you to make informed decisions, ensuring you engage with reputable suppliers who adhere to strict quality control standards and safety protocols.

Comprehensive insurance coverage provides businesses with financial protection in the event of product liability issues, legal actions, or safety concerns that may still occur despite diligent supplier assessments.

By combining meticulous supplier evaluations with robust insurance solutions, you not only enhance your risk management strategies but also boost your confidence and resilience as an online seller.

Transparent product information

Clear product details and effective warnings are paramount in safeguarding customer well-being and minimizing product liability risks.

Providing detailed and accurate product information whether it be in your product titles and descriptions or on your packaging and product inserts – explicit warnings of potential dangers or misuse, fulfills your legal obligations and fosters customer trust.

Managing customer feedback

Proactively managing customer concerns is critical to maintaining trust, reputation, and business sustainability. Addressing customer inquiries, complaints, and feedback quickly and effectively resolves immediate issues and demonstrates a commitment to customer satisfaction.

This approach fosters loyalty, encourages repeat business, and can even turn dissatisfied customers into brand advocates.

By actively listening to and addressing customer concerns, businesses can identify potential product or service improvements, enhancing overall quality and competitiveness.

How Insurance Providers Assist Online Sellers

Insurance providers play a pivotal role in helping businesses navigate the complexities of risk assessment and coverage. We offer valuable expertise, leveraging our deep understanding of the eCommerce industry and potential risks.

By conducting thorough risk assessments, we can identify vulnerabilities within a business’s operations and supply chain, allowing for a tailored approach to coverage.

This personalized insurance solution will align with the unique risks and needs of your business, ensuring that any potential liabilities are adequately mitigated and enhancing a business’s overall resilience in the face of unforeseen challenges.

Tailored legal protection

Insurance providers offer a comprehensive array of protection plans tailored to the unique requirements and product liability risks of any eCommerce business, regardless of its size or success level. These specialized insurance solutions are experienced at addressing the specific challenges faced by eCommerce enterprises concerning product liability, taking into account variables such as the type of products sold, the scale of operations, supply chain complexities, and potential legal liabilities.

Whether it’s a small startup navigating its entry into the digital market or a superseller with hundreds of products in their catalog, insurance providers have the expertise to customize protection plans that effectively mitigate product liability risks. These plans ensure that businesses can confidently navigate the intricate eCommerce landscape, all while maintaining consumer trust and safeguarding their bottom line.

Expert legal guidance

Insurance providers can offer online sellers guidance that encompasses not only financial protection but also proactive strategies to ensure compliance with legal requirements and implement best practices.

This expertise can help businesses understand the legal landscape, ensuring that they meet all relevant product safety regulations, standards, and labeling requirements. Moreover, insurance professionals can offer insight into protecting intellectual property rights, helping sellers safeguard their brands and products from counterfeits and copyright infringements.

Proactive risk management

Insurance providers actively promote proactive risk management by forging close partnerships with online sellers to identify potential legal vulnerabilities and recommend tailored strategies for minimizing product liability exposure. Through comprehensive assessments of a seller’s operations and products, insurers pinpoint areas of concern, whether related to safety compliance, intellectual property rights, or regulatory standards.

They then collaborate closely with sellers to create proactive risk mitigation measures, such as strengthening quality control protocols, refining product labeling and safety guidelines, and establishing recall procedures. This collaborative approach not only reduces the likelihood of legal disputes but also empowers online sellers with an understanding of legal requirements and industry best practices.

Accurate insurance coverage

In eCommerce, where online sales can fluctuate significantly, having an insurance provider who can offer the most accurate insurance coverage is important. One innovative insurance model that aligns seamlessly with the dynamic nature of online sales is the “pay-as-you-sell” insurance approach.

Unlike traditional insurance models with fixed premiums, this flexible model allows online sellers to adjust their coverage and premiums in real-time based on their actual sales volume.

The advantages of this approach are twofold: cost-efficiency and flexibility. Sellers are not locked into fixed premiums that may not align with their sales patterns, ultimately saving on insurance costs while ensuring they are adequately covered during peak sales periods.

However, the accuracy of insurance coverage also hinges on correctly categorizing products for insurance purposes. Product misclassification can lead to significant issues, like being under- or overinsured. That’s why Assureful monitors 28,000+ product categories for the most accurate representation of every product we insure.

Assureful’s Innovative Approach

There’s no questioning the importance of having adequate general liability insurance when you’re an eCommerce business owner – so why choose Assureful?

Assureful is leading the way in the pay-as-you-sell eCommerce insurance space.

Our automated, instant quote system allows you to get a bespoke insurance quote tailored to your specific needs, at the best price, without the need for lengthy forms or complicated calculations.

Here’s what sets Assureful apart:

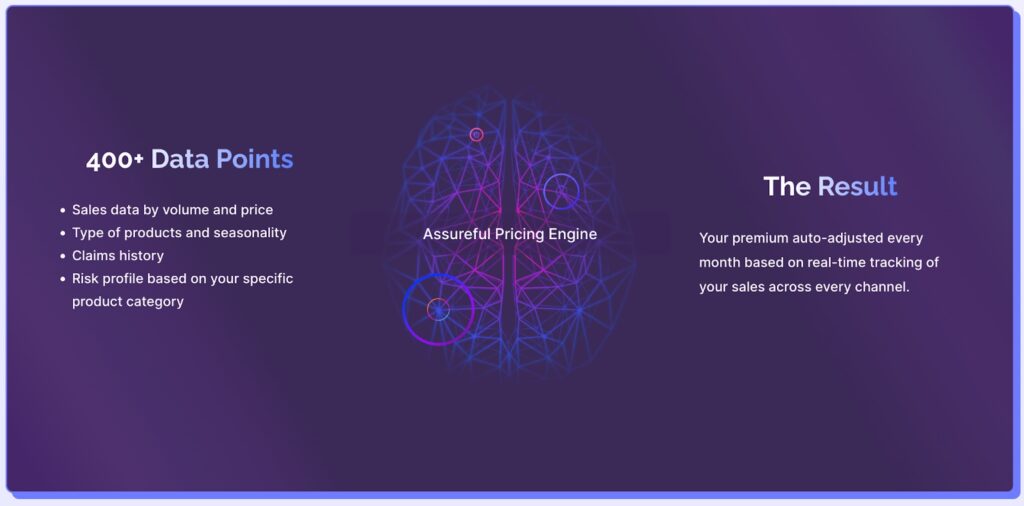

- Automated Quotes: Our proprietary machine learning technology provides sellers with a bespoke insurance quote based on 400+ data points like past sales data, type of product and seasonality, claims history, and many more. This eliminates the guesswork involved in traditional insurance models and ensures sellers get the right coverage at the right price

- Seamless Integration with Major eCommerce Platforms: Assureful connects with all major eCommerce platforms, including giants like Amazon, Walmart, Shopify, eBay, and Etsy, for seamless adjustments to your cover in line with actual monthly sales

- Private Label and Dropshippers: Insure your entire product range, including imports from China that traditional insurers often reject

- Accurate Pricing: We base our pricing on real-time tracking of 28,000+ product categories

- Adjust Your Product Catalog Without Any Paperwork: As we connect with your selling platforms, your premium will automatically adjust if you add or remove products from your catalog – no need to notify us

Sign up today to receive your quote in minutes.

No obligation quote.

Policies can be canceled at any time, with 30 days’ notice.

0 Comments