Warning all Amazon FBA sellers: Are you risking your business’s future with inadequate insurance?

In an industry that can change so rapidly at just the click of a button – one viral video skyrockets your business overnight or one negative review sends it plummeting in a matter of days. The opposite can also happen – a listing suppression stalls your sales, or an influx of competition steals your PPC spots. One thing is for certain, wrongly estimating insurance needs can be a costly mistake.

This blog post is your wake-up call to the hidden dangers and costs of being underinsured or overinsured and how to protect your enterprise from unforeseen financial pitfalls.

Understanding FBA (Fulfillment by Amazon) Insurance

Amazon FBA insurance isn’t just a checkbox on your to-do list. It’s a protective shield for your business.

However, given the wide variety of business types operating on Amazon and the complex machinations of the eCommerce market, it’s a challenge to know what kind of protection is right for your business.

And Amazon leaves little room for ambiguity – If you’re a Pro Merchant or if your monthly sales surpass $10,000 in any given month, Commercial General Liability Insurance isn’t optional. It’s a demand.

Explore our full guide on Amazon’s insurance requirements.

Signs You May Be Overpaying for Amazon FBA Insurance

Every business is different, and there’s no one way to go about choosing a policy. However, there are a range of common mistakes we see when businesses are looking for Amazon seller insurance, including:

- Generic policy selection: While one-size-fits-all policies can make choosing insurance simpler, they often saddle your business with unnecessary extra services while under serving you for core liabilities.

- Not shopping around for better rates: Insurance is highly competitive, so settling for the first price you find is nearly always a missed opportunity. Comparing multiple providers can ensure you have the best combination of price and value.

- Choosing unnecessarily high coverage limits: While high coverage can feel like extra peace of mind, your policy details should match the real risks you face. Unused coverage just adds to your overheads without delivering any benefit to your business.

- Not reviewing policies: The insurance market moves fast, with premiums and rates varying regularly. Some providers will increase your prices over time, leaving you with higher costs, especially if you’ve selected auto-renewal.

However, while overpaying is common, underpaying can also damage your business, leaving you open to unnecessary risk.

Signs You May Be Underpaying for Amazon FBA Insurance

The entire purpose of insurance is to ensure that your business has the protection it needs. But if you’re underpaying on your policy, you may find yourself high and dry at the worst moment.

Key signs that you might be underpaying for your Amazon FBA insurance include:

- Sacrificing coverage for a lower premium: While the upfront cost of insurance can be daunting, finding out that you’re exposed when something goes wrong can be much more damaging.

- Opting for policies with high deductibles: Judging the right deductible for your business is a balancing act. Consider the potential commercial impact of a serious claim – if the deductible is too high, you might realize you’re covering nearly all the cost yourself. And, you may be in violation of Amazon’s requirements, which requires all compliant deductibles to be below $10,000.

- Overlooking policy exclusions: The devil’s in the details when it comes to your insurance. Ensure that your policy actually covers the true risks your business faces before you need to make a claim, not after.

- Ignoring long-term costs of being underinsured: While insurance may seem like a luxury, the benefits accrue in the long term. If you wait until you’ve had to cover several incidents out of pocket, you may find you’d have been better off getting insurance all along.

Learn more about insuring the products you’re selling on Amazon in our related article: How Much Product Liability Insurance Do I Need?

Finding the Balance of Coverage

Despite the complexity of the insurance market, there are clear routes to finding the right policy. A structured and proactive approach can ensure you have the right coverage at the right price.

Evaluate Your Risks

Every business has unique risks. Understand yours and tailor your insurance accordingly, including checking the exclusions and deductibles to determine whether you have the right balance of protection and cost.

Read our article on products with hidden risks so that you don’t get caught out.

Something also to be aware of is the risk of product miscategorization. This is increasingly becoming a problem for product sellers on platforms like Amazon.

Wrongly categorized products can leave you exposed to being underinsured or paying for coverage you don’t need.

Get Expert Help

An experienced insurance agent can navigate the nuances and help you find the perfect fit, including diagnosing your needs and helping you compare the details of various policies.

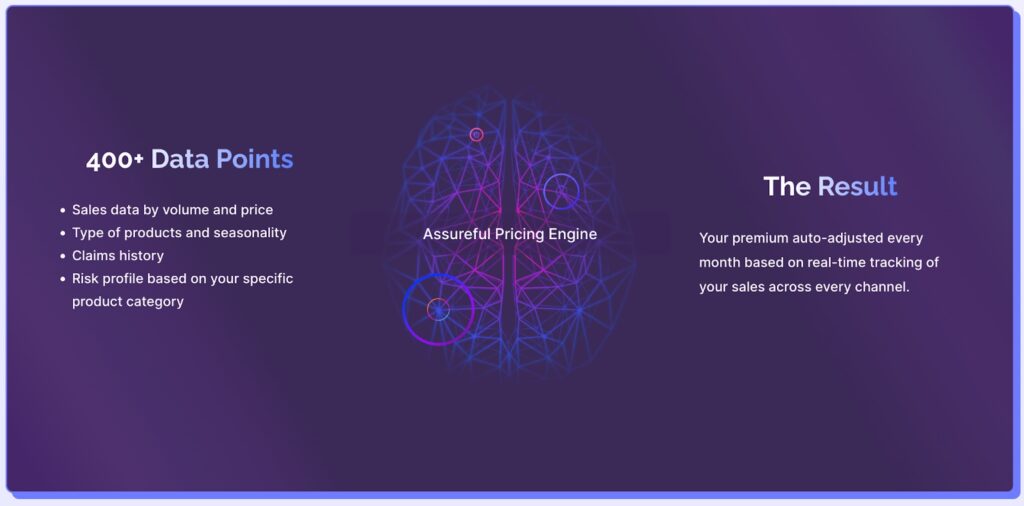

At Assureful, our Pay-As-You-Sell Pricing Model provides quotes based on 28,000+ product categories and 400+ data points like your past sales data, type of product and seasonality, claims history, and much more. This ensures our customers get the best coverage at the lowest possible price.

Shop Around

Don’t just go for your first quote. Compare offers from different insurers for the best deal.

We believe in empowering our customers with knowledge. While we’re confident in the value and comprehensiveness of our tailored Amazon coverage, we also understand the importance of making an informed decision. We encourage all online sellers to explore, compare, and then choose the best fit for their business and their needs.

Know Your Policy

Understand your policy’s terms and conditions so there are no unpleasant surprises later. A few extra minutes reading the fine print today can yield big benefits in the future. Learn more about your insurance policy by reading our guides on:

Update as You Grow

Your insurance should evolve as your business does. Set a reminder in your calendar well before your renewal date to make sure your policy still covers your needs and to compare market prices for the latest deals.

As an Assureful customer, you won’t have to worry about your policy renewal, with a monthly policy that auto-adjusts along with adjustments to your sales and product mix.

Choosing the Right Amazon Seller Insurance Provider

Choosing the right Amazon seller insurance provider can be the difference between success and failure – especially in the face of an unforeseeable product liability claim.

You need to find the right level of coverage to manage your costs, while ensuring you can confidently grow your eCommerce business. By recognizing the signs of overpayment and underpayment for Amazon FBA insurance, you can make informed choices based on your strategic goals and plans.

If you’re ready to make your insurance work for you, explore our smart product liability insurance solutions, tailored to eCommerce entrepreneurs like you.

No obligation quote.

Policies can be canceled at any time, with 30 days’ notice.

0 Comments