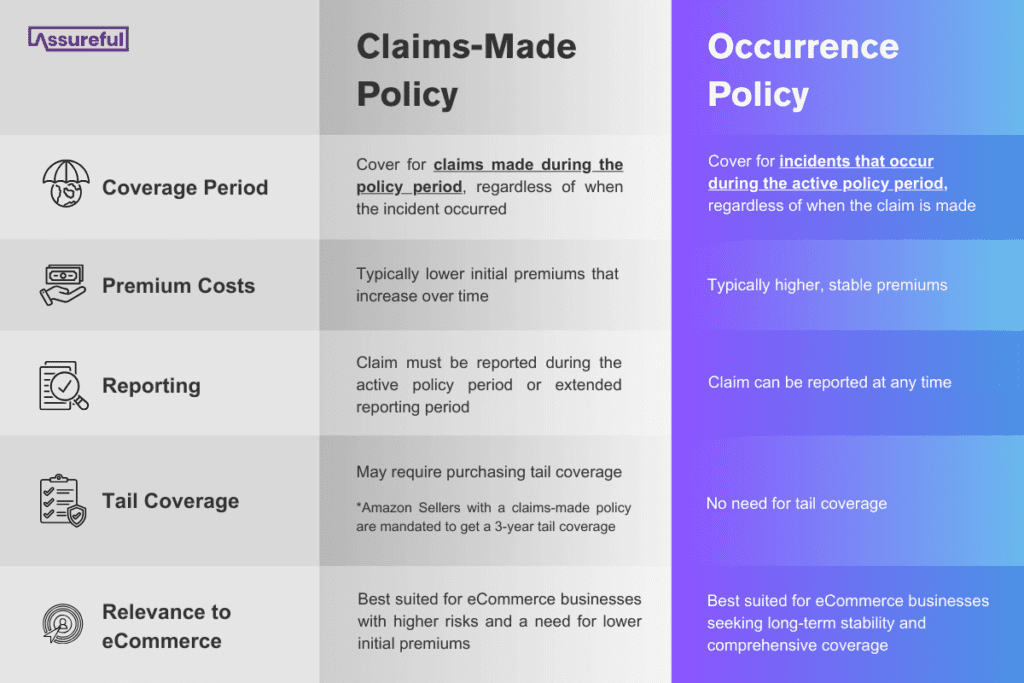

A claims-made policy covers claims that are made during the policy period, making it crucial to maintain continuous coverage and consider securing tail coverage. Contrastingly, occurrence policies cover incidents that occur during the policy period, granting protection even if the claim is reported after the policy has expired.

Choosing the right type of insurance policy for your eCommerce business is crucial, and it’s here that the debate between claims-made vs occurrence policies emerges.

Navigating that debate is about understanding and aligning your liability insurance with the nuances of your operations, ensuring that your insurance coverage is comprehensive, adaptable, and a seamless fit for your business model.

This guide will help you understand the types of insurance policies available to you and the implications they hold for your eCommerce venture.

Claims-Made Policies Explained

At the most basic level, a claims-made policy is a type of insurance policy that provides coverage for claims only if the claim is made while the policy is active, regardless of when the incident occurred. For eCommerce businesses, especially those operating on platforms like Amazon and Walmart, a claims-made policy ensures coverage for any liability arising from the products sold, as long as the claim is reported while the policy is in force.

Some other factors come into play when it comes to the scope of your coverage, so we’ll cover those next.

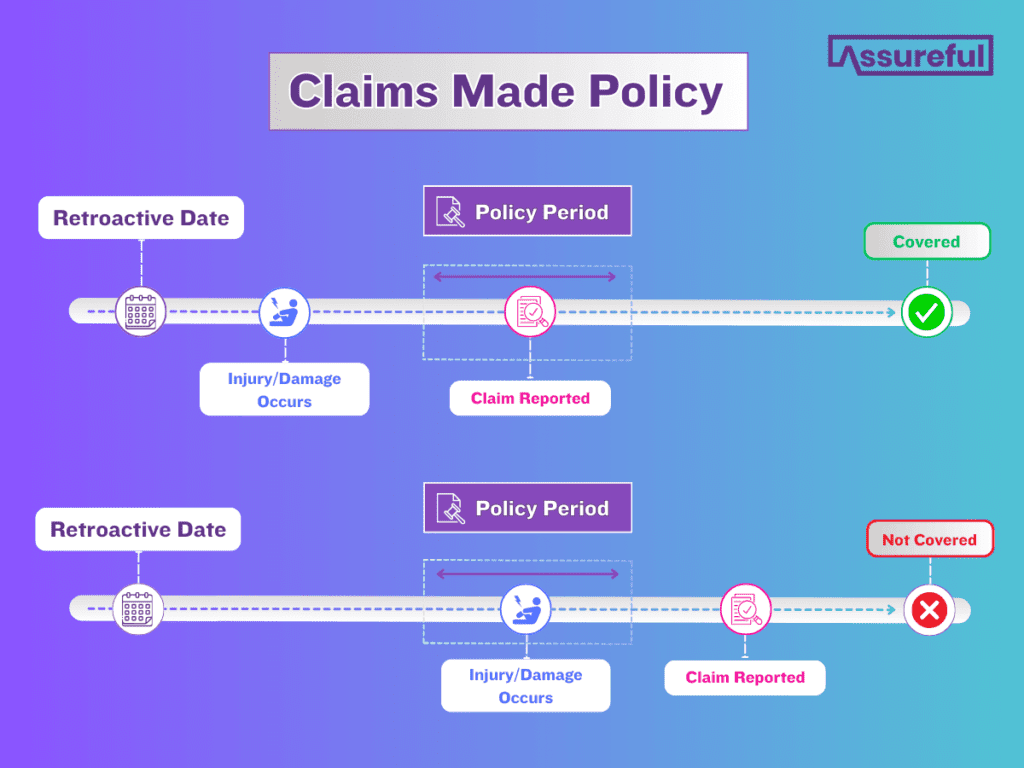

Scope of Coverage and Retroactive Date

Claims-made policies are distinctive due to their reliance on the time that the claim is reported.

However, the date that the incident occurred is still a factor you need to be aware of. Your policy provides coverage if the incident occurred after a specified date – the retroactive date.

For example, say your policy starts in January 2023, with a retroactive date of October 2021. If a customer files a suit against you in March 2023, for an incident that occurred in November 2021, then your insurance protects you against that claim. If that incident had occurred in September 2021 (before the retroactive date), you would not be protected.

Tail Coverage and its Significance

Tail coverage is an addition to your claims-made policy that extends your coverage beyond your policy period for incidents that happened during your policy period – even if the claim is made after your policy period.

Platform-specific requirements also come into play here. Amazon, for example, mandates a minimum of three years of tail coverage for sellers who obtain a claims-made policy. This requirement of extra cover often results in a higher premium when compared to an occurrence policy – but is necesary protection for your business.

When Do I Need to Take Out a Claims-Made Policy?

At Assureful, we recommend taking out a claims-made policy when the risk of the product is deemed high. For example, if you’re selling certain types of higher-risk baby products then there is too much risk to use an occurrence policy.

Don’t get hung up on which cover you think is best for you and your eCommerce business. Get your free quote today and we will recommend the correct policy type to protect you against liability.

No obligation quote.

Policies can be canceled at any time, with 30 days’ notice.

Occurrence Policies Explained

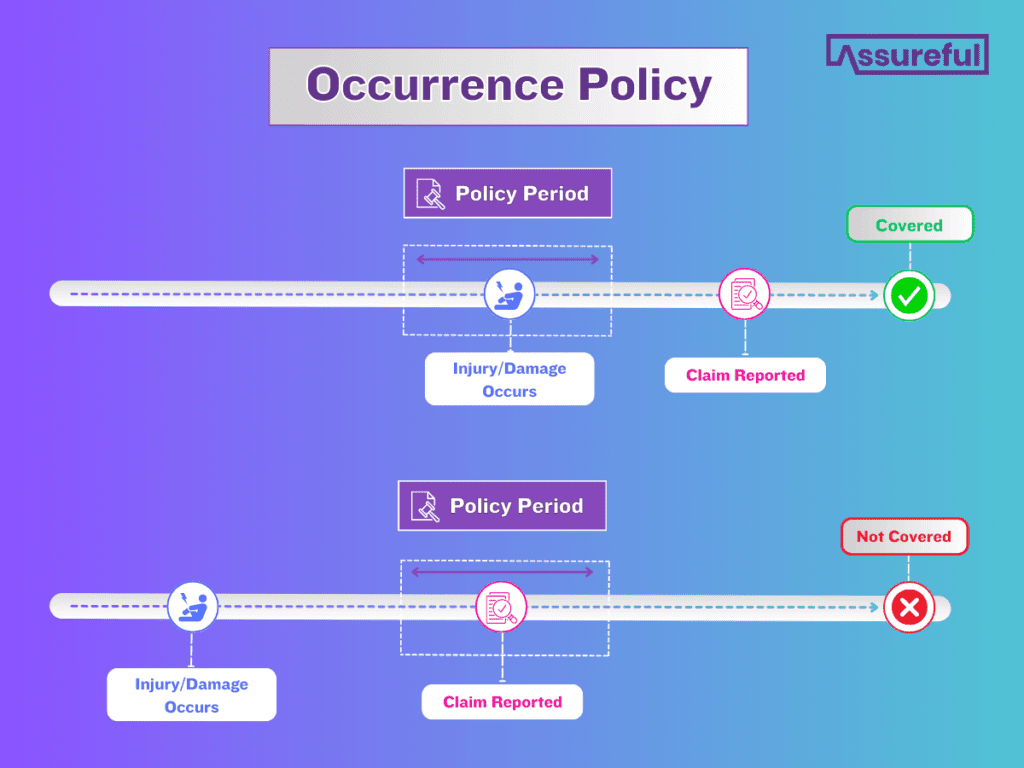

An occurrence policy covers claims stemming from incidents that occur during the policy period, regardless of when they are reported.

For eCommerce entrepreneurs, this implies enduring peace of mind, knowing that even if a claim is reported after the policy expiration, it is covered if the incident occurred during the effective policy period.

When Do I Need to Take Out an Occurrence Policy?

At Assureful, we recommend occurrence policies when the goods you’re selling are in a lower-risk category. For example, if your business sells books, these are deemed lower risk so an occurrence policy would usually be better suited to your needs.

Key Differences between Claims-Made and Occurrence Policies

The key differences between these policy types revolve around the timing of the incident itself and the reporting of the claim.

With claims-made policies, the validity of your claim depends on the reporting time – the policy must be active for the claim to be covered. With occurrence policies, the key timing is on when the incident occurred – with lasting protection even if a claim is made after the policy has expired.

Selecting the right type of policy is not just about ticking off a compliance box. It’s about forming a safety net that aligns with the business’s rhythm for an optimal blend of protection, flexibility, and peace of mind.

Assureful provides accurate, monthly-billed coverage based on actual sales and recommends the best policy type for your business. Designed specifically for eCommerce sellers.

No obligation quote.

Policies can be canceled at any time, with 30 days’ notice.

Assureful: Insurance Designed for eCommerce

As an eCommerce seller, it’s crucial to understand the difference between claims made and occurrence policies to avoid any gaps in your insurance coverage. Gaps in your coverage due to changing provider or policy type could leave you open to unnecessary risk, especially when dealing with liability related to products imported from global sources, including China.

While understanding the profound implications of choosing each type is essential, the decision over the policy type offered to you is often in the hands of your provider.

At Assureful, we come from eCommerce and understand the absolute importance of ensuring your coverage evolves with both your business and the changing eCommerce landscape. That’s why offer a range of claims-made and occurrence policies, tailored to your unique business model, product categories, and sales data – all powered by our proprietary technology to determine the best policy type and price.

Get an instant free quote today for the most accurate and fairly priced insurance to fit your eCommerce needs – with premiums starting from just $26 per month.

No obligation quote.

Policies can be canceled at any time, with 30 days’ notice.

0 Comments