eBay processes thousands of transactions every single day – which is no surprise considering there are more than 135 million eBay users worldwide and 1.2 million visits each month.

The importance of securing your venture has never been more pertinent, with the rise of eCommerce disputes and liabilities. eBay seller insurance is an indispensable tool in navigating the current eBay selling landscape, providing a robust safety net that ensures the continuity and resilience of your eBay venture.

On the face of it, business insurance may seem like “just an extra expense”, but it’s an investment in securing the future of your online business. It safeguards you from the financial ramifications of any unpredicted claims and lawsuits. Granting you peace of mind so you can focus on doing what you do best: being a business owner and growing your eCommerce store.

eBay Seller Insurance Requirements

So you may be wondering, “Does eBay require me to have insurance?”

Well, unlike Amazon which requires its sellers to maintain Commercial General Liability Insurance once their revenue reaches $10,000 in any given month, eBay does not mandate its sellers to carry any particular insurance.

Yes, that’s right: no specific liability insurance requirements are in sight. But, that doesn’t mean you should break easy just yet.

Regardless of whether it is mandated by your online retail platform, we still highly recommend you protect your business by carrying the right business liability insurance as a safety net.

Am I Protected as a Seller on eBay?

With some eCommerce marketplaces, like Amazon, offering a small level of protection with their A-to-z Guarantee, it brings forth the question: “Am I protected as a seller on eBay?”

While eBay does have a Seller Protection Policy to safeguard sellers from events they term as “abusive buying behavior” or “outside your control.”, the level of protection for sellers is limited to minor issues like:

- A product that was shipped on time but arrived late to the customer

- A buyer retracting their bid or not paying

- A buyer changing their order or requesting something extra

For an exhaustive list and in-depth details, be sure to read the eBay Seller Protection Policy.

When it comes to these grievances, eBay will hold your funds until the issue is resolved or deduct the disputed amount from your eBay seller account. If the issue escalates, the buyer could sue your business – a risk that eBay does not provide any cover against, with their User Agreement also stating:

“In addition, to the extent permitted by applicable law, in no event will eBay (including our parent, subsidiaries, and affiliates, and our and their officers, directors, agents, and employees) be liable to you or any third party under any claim at law or in equity for any consequential damages or losses (including, but not limited to, loss of money, goodwill or reputation, profits, other intangible losses, or any special, indirect, or consequential damages), and all such damages or losses are expressly excluded by this agreement whether or not they were foreseeable or eBay was advised of such damages or losses.”

So, while eBay provides a small degree of protection, remember: the security of your business is ultimately in your hands.

That’s why we recommend taking out a liability insurance policy to protect your venture, regardless of what platform you choose for conducting your eCommerce business.

Accurately rated and fairly priced Commercial General Liability Insurance for your eBay business

Assureful provides accurate, monthly-billed coverage based on actual sales – not inaccurate yearly forecasts. Designed specifically for eCommerce sellers.

No obligation quote.

Policies can be canceled at any time, with 30 days’ notice.

Exploring Types of eBay Business Insurance

An understanding of the various layers of protection available to shield your eBay business from the myriad of risks inherent in eCommerce is essential. Each type of liability insurance serves a unique purpose, addressing various vulnerabilities you may encounter.

Commercial General Liability Insurance

At a glance, Assureful’s Commercial General Liability Insurance includes coverage for:

- Third-party bodily injuries and medical expenses

- Tangible damages like someone’s physical property

Product Liability Insurance

Often, like in the case of Assureful liability coverage, your commercial general liability policy may include cover for product liability, but this can also be obtained separately.

Product Liability Insurance shares similarities with General Liability Insurance but is a distinct form of coverage specifically tailored for businesses involved in manufacturing or selling products – such as eCommerce brands.

Product liability policies are specifically limited to claims that involve product defects.

Business Owner’s Policy

At its core, a business owner’s policy (BOP) is a savvy blend of General Liability and Commercial Property Insurance.

It is designed to protect businesses from claims resulting from things like fire, theft, or other disasters, as well as claims that could arise from business operations, such as bodily injury or property damage.

In one cost-effective package, it shields you from the potential pitfalls of bodily injury lawsuits and property damages and is a worthwhile consideration if you own or rent a property to store and distribute goods.

A BOP is only recommended for eCommerce businesses that have employees and their own brick-and-mortar premises to hold stock and use as offices.

Workers’ Compensation Insurance

Scaling often means growing your team, and bringing about increased responsibility, particularly in ensuring their well-being.

This is where workers’ compensation insurance shines, acting as a critical shield against unforeseen events.

In many US states, having this coverage isn’t optional, it’s mandated for retailers with employees.

While the value of this type of insurance is clear for larger businesses, even sole proprietors can benefit, ensuring they’re protected from work-related injuries that conventional health insurance might sidestep.

Cyber Insurance

Cyber Insurance is your shield against threats of data breaches and cyberattacks.

It’s a proactive strategy, and with some policies including integrated fraud monitoring services, they ensure that sellers remain vigilant and a step ahead of potential cyber adversaries.

Cyber insurance is a valuable option for those looking for assurance that their business, and their customers, will be protected in the event of cyber crimes.

Commercial Umbrella Insurance

Commercial Umbrella Insurance is a unique insurance that essentially acts as a booster to your current liability policies. This type of coverage jumps into action the moment your primary policy limits are reached, ensuring that sellers aren’t left high and dry when faced with an expensive claim.

If an unprecedented incident occurs, this provides an extra layer of financial confidence and safety net to protect your business.

After all, a business that’s well-covered demonstrates foresight, responsibility, and a dedication to smooth operations.

Assureful: Tailored Insurance for eBay Sellers

The intricacies and nuances of the eCommerce landscape can be difficult to navigate. That’s why we designed Commercial General Liability Insurance specifically for eCommerce.

Our eBay liability insurance aligns with the diverse spectrum of risks and vulnerabilities inherent in selling on eBay – with coverage that includes product liability coverage at the lowest possible price.

✓ Monthly billed based on your actual sales

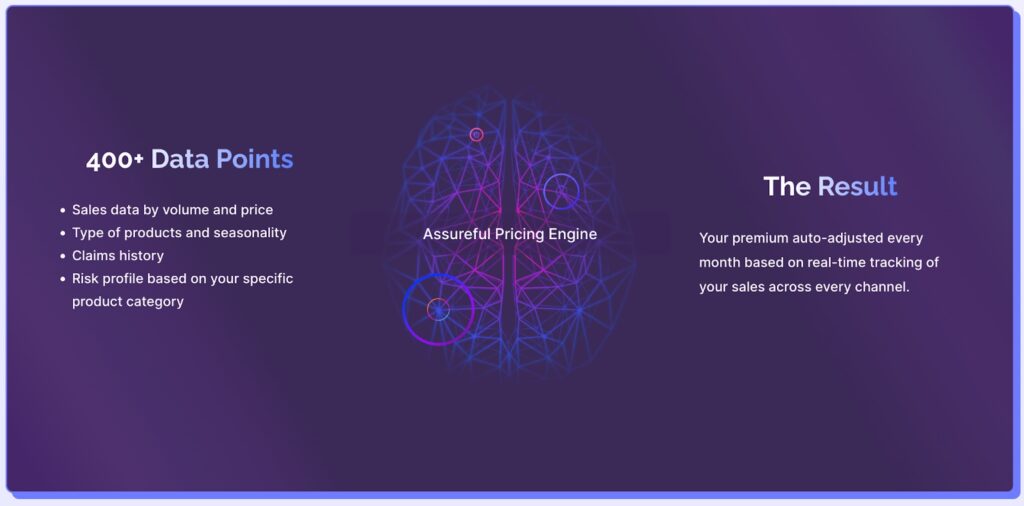

✓ Automated, accurate rating based on hundreds of data points

✓ Designed by eCommerce and insurance experts

How to Get eBay Seller Insurance

Assureful’s pay-as-you-sell insurance ensures you maintain the right level of coverage, at the best possible cost. With premiums calculated and billed monthly, based on your actual monthly sales, not annual forecasts.

Your custom insurance premium for your eBay venture will vary depending on the type of products you’re selling and the perceived risk level – all determined by our machine learning algorithm to categorize your product(s) as accurately as possible.

Get your free no-strings quote today for the most accurate and competitive rates to fit your business needs – and save on Commercial General Liability Insurance for your eBay business.

No obligation quote.

Policies can be canceled at any time, with 30 days’ notice.

0 Comments