When the pace of business is as swift as a click, traditional insurance models often can’t keep pace.

eCommerce sellers, you know the drill. You’re navigating a dynamic landscape: a social media video goes viral and your sales surge overnight, revenue fluctuates with seasonal trends, or even worse, a global pandemic hits and brings your entire business to a standstill.

Yet, when it comes to insuring your business, you’re tethered to static annual projections.

These projections, more often than not, are shots in the dark. They either leave you vulnerably under-insured, in the event you sell more than your annual projections, or burdened with overpriced premiums for sales you didn’t make. It’s a lose-lose situation.

But what if there was a better way – that doesn’t lock you into rigid yearly forecasts?

In this article, we’ll compare the limitations of traditional insurance models with the new age of insurance based on real-time data and monthly premiums.

The Limitations of Traditional Insurance Models

- The Guesswork of Annual Projections: Yearly forecasts are, at best, educated guesses. But in the fast-paced world of eCommerce, where trends can shift overnight, these projections often miss the mark. On average, premiums per product for liability coverage hover around $1,200 a year – so the larger your product catalog, the more you’re left grappling with the unreliability of these estimates.

- The Balancing Act of Coverage: With these off-target projections, you’re constantly walking a tightrope. Overestimate, and you’re shelling out for coverage you don’t need. Underestimate, and you’re left exposed to risks and could lead to a premium audit which can be pricey and time-consuming. It’s a precarious balance.

- The Financial Strain: Traditional models often come with a lofty price tag. Whether it’s the burden of lump-sum annual payments or the sting of high-interest premium financing, your bottom line feels the pinch.

- A One-Size-Fits-All Approach: Most traditional insurers shoehorn unique business models into generic categories, leading to misaligned coverage and potential liability nightmares.

- The Sign-Up Marathon: Days of back-and-forth, heaps of paperwork, and overwhelming effort for just one product… and then you must move on to your next products. It’s a process that tests your patience.

At Assureful, we’ve taken these challenges to heart. We believe there’s a better way, one that aligns with the realities of eCommerce and offers a tailored solution hinging on data and adaptability,

Introducing Our Dynamic Pricing Model

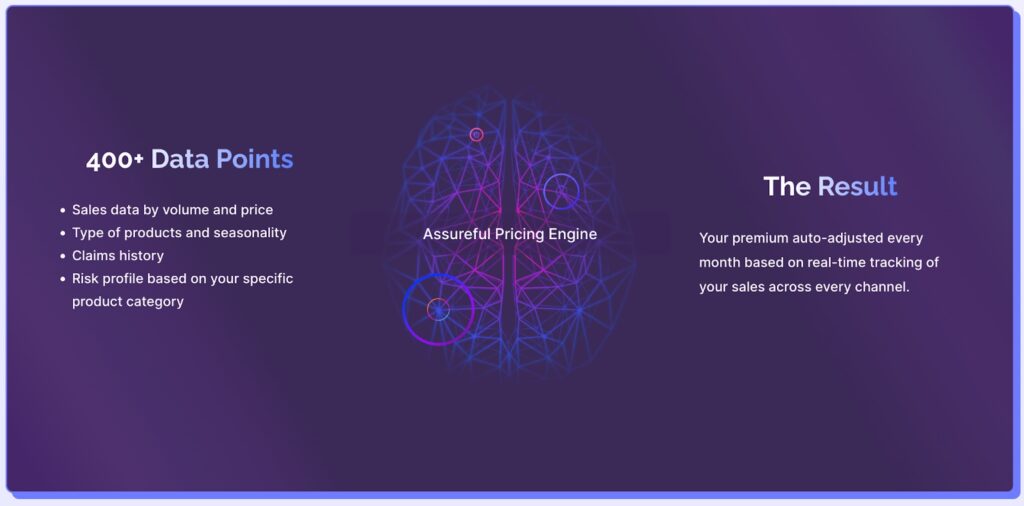

Our machine-learning pricing engine is designed with this very ethos in mind. Let’s explore how our dynamic approach to insurance is changing the landscape for eCommerce sellers.

Constantly Analyzing, Learning, and Adapting

- A Symphony of Data Points: Our model doesn’t just rely on a handful of data points. Over 400 points are automatically analyzed including historic sales data, the types of products you sell, seasonality, your most recent sales, claims history, and so much more. This rich tapestry of information allows us to tailor your coverage with pinpoint accuracy – never leaving you underinsured, never charging you too much.

- Deeply Accurate Insights: We connect directly to your seller accounts on Amazon, Walmart, Shopify, and other major platforms – pulling real-time sales data down to the SKU or product level. This granular data is the foundation upon which our coverage is built.

- Seamless Data Capture: At the heart of our model is a system that automatically captures essential data. For our valued customers, this means no more manual data entry or tedious paperwork. We’ve got it all covered, ensuring a hassle-free experience – so you can concentrate on scaling your business.

Ensuring You Get the Best Coverage

At Assureful, we offer not just comprehensive coverage, but often a more cost-effective solution for eCommerce sellers:

- Products Categorized With Precision: With over 30,000 categories, our proprietary machine learning algorithm accurately categorizes every one of your products individually based on their risk profile. This nuanced approach ensures you’re not overpaying based on a few high-risk items in your inventory.

- Paying for Reality, Not Projections: One of the cornerstones of our model is its adaptability. Instead of locking you into annual projections, Assureful customers pay as they sell based on actual sales every single month. No overestimations, no underestimations, just fair and accurate billing.

- Hassle-Free Billing: With recurring billing and automatic invoicing, you can set it, forget it, and focus on growing your eCommerce business.

- Expert Claims Handling: Should the need arise, rest assured that your claims are in expert hands. Our licensed Third-Party Administrators (TPAs) and adjusters ensure a smooth, efficient, and fair claims process. While customer support is on hand to answer any questions when you need them.

- Say Goodbye Middlemen: Traditional insurance often comes with layers – brokers, agents, and intermediaries, all contributing to potentially inflated premiums. At Assureful, we’re not a broker, we’re the underwriter, helping you secure the best possible price for your eCommerce insurance.

- A Paperless Revolution: From sign-up to claims, our process is fully digital, ensuring speed, efficiency, and a reduced carbon footprint.

In a nutshell, Assureful’s approach is about aligning premiums with reality. It’s about leveraging technology to offer fair, transparent, and affordable insurance. With our dynamic pricing model, you’re always covered, always protected, and always ahead of the curve.

Explore the importance of product liability insurance with McDonald’s $3 million hot coffee lawsuit.

Always On, Always Learning

Yesterday’s data is old news. In the dynamic world of e-commerce, where change is the only constant, why should your insurance remain static? Traditional models, with their rigid projections and inflated costs, aren’t serving the needs of eCommerce sellers.

That’s why we developed our model to be agile, adaptive, and as forward-thinking as your business.

In essence, Assureful isn’t just about insurance. It’s about understanding eCommerce’s unique challenges and nuances and crafting solutions that resonate. With us, you’re not just covered; you’re empowered, protected, and poised for success.

Ditch the Guesswork, the Paperwork, and the Overpriced Premiums

Step into the new age of insurance with Assureful. Get your tailored quote today and experience the difference firsthand.

No obligation quote.

Policies can be canceled at any time, with 30 days’ notice.

Common Questions Answered

What happens if my sales exceed projections mid-month?

Your premium for the following month will be adjusted to ensure you remain covered. That’s the beauty of our automated monthly premiums.

Are there any additional costs or fees associated with monthly premium adjustments?

No, there are no additional costs or fees associated with your coverage.

What platforms does Assureful integrate with?

Assureful integrates with all major eCommerce platforms to provide your accurate monthly premium. Currently, you can connect the following seller accounts: Alibaba, Amazon, BigCommerce, eBay, Etsy, FNAC, Lazada, Magento, Mercado Libre, PrestaShop, Shopee, Shoper, Shopify, Shoplazza, Shopline, Squarespace, Walmart, Wix, WooCommerce.

What products do you cover?

Assureful General Liability Insurance covers products across 32,000 categories. To check whether we cover a specific product, get your free quote today.

What if I add or remove a product during the year?

You don’t have to notify us. We will automatically add the product to your coverage or remove it and adjust your premiums accordingly.

How is Assureful cheaper than other similar providers?

As we are built for eCommerce, we understand the risks at a more fundamental level. By monitoring over 30,000 product categories and analyzing 400+ of your data points allows us to give you the most personalized coverage. Your cover is also based on your actual sales in the last 30 days so we reflect your real needs, not arbitrary annual forecasts.

0 Comments