82%

That’s the percentage of small businesses that fail that experience cash flow problems.

If that number shocked you, then read on to find out more about managing cash flow as an Amazon seller.

First: What is Cash Flow?

Cash flow is essentially all of the money that flows in and out of your business.

But why is it so important?

It’s the lifeblood of your business and a positive cash flow is crucial to your survival and growth. Without it, your business could struggle to meet its financial obligations, like paying suppliers or covering operational costs. This could lead to a whole host of problems, from stunted growth to the eventual closure of your business.

So, how can you improve your cash flow as an Amazon seller? We’ve compiled a list of strategies that can help you keep your cash flow healthy and your business thriving:

- Track incomings and outgoings

- Optimize and closely monitor inventory

- Shorten your cash cycle

- Get Pay-As-You-Sell insurance

- Negotiate with suppliers

- Plan ahead

- Diversify

- Cut unexpected expenses

Tip #1: Track Incomings and Outgoings

The first step to improving your cash flow as an Amazon seller is to track your incomings and outgoings. It might sound like a no-brainer, but you’d be surprised how many entrepreneurs let this basic principle slip.

Think about it. How can you improve your cash flow if you don’t know what cash is flowing into and out of your business? That’s why running the numbers isn’t just for your accountant. It’s a crucial part of your role as an eCommerce business owner.

So, what should you be tracking? Here’s a list to get you started:

- Monthly expenditure: This includes everything from inventory costs to advertising expenses and fixed overheads

- Monthly revenue: By keeping a clear picture of your sales

- Inventory levels and rate your inventory is selling: This can help you forecast future sales and manage your inventory levels more efficiently

- Projected re-stock dates: By forecasting your inventory needs and estimating when the expense of a large inventory order is looming, you can plan your spending and keep your cash flow positive

Remember, the key to effective cash flow management is gaining a clear picture of your financial situation right now to effectively forecast your future cash flow.

Tip #2: Optimize and Closely Monitor Inventory

Another crucial strategy to improve your cash flow as an Amazon seller is to optimize and closely monitor your inventory. Think of your inventory as cash that’s waiting to be processed.

It’s vital to know what inventory you have and the rate at which it’s selling. You can then understand exactly what cash you need to allocate to restocking and the estimated revenue you have coming in and when.

This is where sales forecasting comes into play. By accurately predicting your future sales, you can manage your inventory more effectively and avoid tying up too much cash in unsold stock.

But what if you have excess inventory that won’t sell? This is a common problem for many Amazon sellers, and it can seriously impact your cash flow. Here are three common strategies for selling off dead stock:

- Create product bundles: By bundling slow-moving items with more popular products, you can increase their perceived value and encourage customers to buy them.

- Offer sale pricing: A temporary price reduction can create a sense of urgency and stimulate demand for your excess inventory.

- Analyze your data: Try to understand why you ended up with excess inventory in the first place. Was it due to over-forecasting? Changing trends? Or perhaps something changed in your pay-per-click campaigns that affected their performance?

By optimizing and closely monitoring your inventory, you can keep your cash flow healthy and ensure your business continues to thrive.

Tip #3: Shorten Your Cash Cycle

The next strategy to improve your cash flow as an Amazon seller is to shorten your cash cycle. But what exactly is a cash cycle?

The cash cycle refers to the amount of time it takes a business to convert inventory into cash. In other words, it’s the time between paying your supplier and getting paid by your customers.

Why is this important? Well, the shorter your cash cycle, the less time your money spends tied up in inventory. This means you can turn your inventory back into cash at a quicker rate, improving your cash flow.

Let’s illustrate this with an example. Suppose you estimate that you can sell 50,000 units in 12 months. You can afford to buy all 50,000 units upfront. But should you?

Instead of making a large upfront investment, consider splitting the order into two or more orders. You could order 25,000 units now and another 25,000 units in 6 months. This way, you can reduce your upfront investment, shorten your cash cycle, and keep more cash on hand in your business. This ties right back to tip #2. The only way to effectively implement this strategy is the track and forecast your inventory as accurately as possible.

Tip #4: Get Pay-As-You-Sell Insurance

As an Amazon seller, once you hit $10,000 in revenue in a single month, Amazon mandates you to secure and maintain Commercial General Liability Insurance. Even before hitting this threshold, sellers should seriously consider the liability risks faced by an uninsured business.

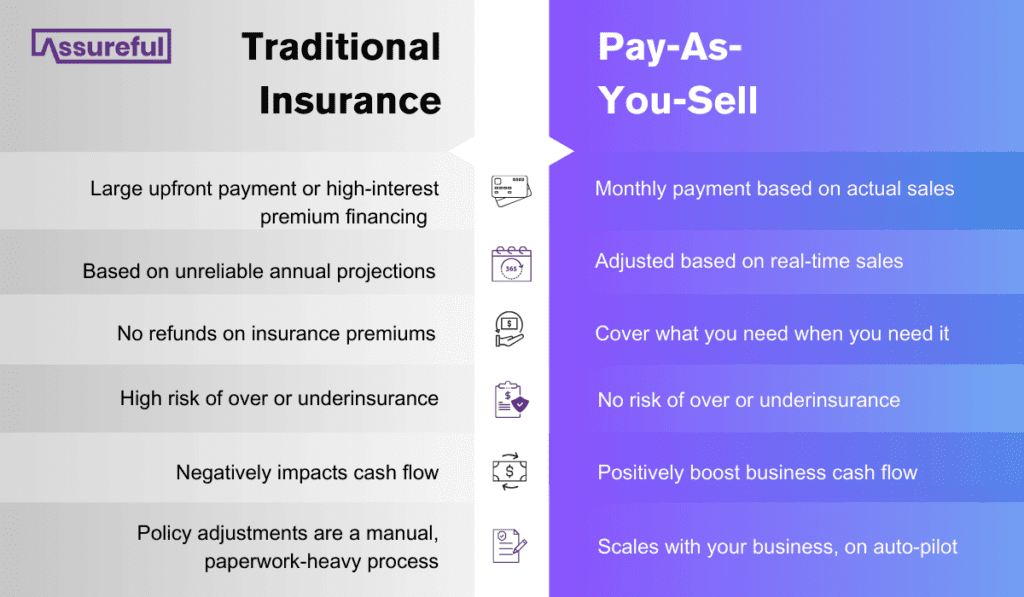

This is where PAYS (Pay-As-You-Sell) insurance comes into play.

PAYS insurance is a model that allows you to avoid shelling out for the large upfront payments associated with annual premiums – and the potentially inaccurate sales forecasts that they’re based on. Have a bad month? No problem, your premium is reduced to reflect that. Have a fantastic month? Your premium increases to reflect that, ensuring you’ve got the coverage you need for every sale you make.

Having insurance that scales and flexes along with your business means you’re not only compliant with Amazon’s requirements but also protected from unforeseen circumstances.

For more information on how PAYS insurance can help improve your cash flow, check out our PAYS insurance guide. It’s packed with practical advice and strategies to help you navigate the world of eCommerce insurance.

Tip #5: Negotiate with Suppliers

As an Amazon seller or eCommerce business owner, your highest expense will likely be the cost of inventory. That’s why it’s crucial to negotiate with your suppliers for the best deals.

Reducing your inventory costs in this way can significantly improve your cash flow and give your business a much-needed financial boost.

But remember, the cheapest deal may not necessarily be the best one. Quality should always be your top priority. So, instead of just focusing on price reductions, also consider ways to negotiate extra benefits at the same price. This could include things like:

- Extra quality checks: To reduce the risk of returns, refunds, and defects

- Better packaging: Packaging goes a long way to enhancing the perceived value of your products and attracting more customers

- Free product inserts: This simple piece of card inside your packaging can help promote your brand, encourage repeat purchases, and generate more reviews

By negotiating with your suppliers, you can not only improve your cash flow but also enhance the quality of your products and the satisfaction of your customers.

Tip #6: Plan Ahead With Cash Flow Forecasting

We’ve already talked about inventory and sales forecasting – but taking a wider view to generate cash flow forecasts as a whole is also an important aspect of being successful as a seller.

By estimating your cash on hand at any given point based on factors like fixed expenses, sales forecasts, and restocking costs, you can make informed decisions and avoid the cash flow problems that befall so many businesses.

What you do with this forecast is dictated by other considerations, one of which is the seasonality of your products. Understanding and anticipating the regular fluctuations in sales due to seasonality will allow you to plan for those times when revenue is slow but your overheads are still there and suppliers still need to get paid.

Remember, planning ahead is not just about preparing for the worst. It’s also about positioning your business for growth and success. By forecasting your cash flow and planning your business expenditure, you have the financial safety net to seize opportunities when they arise and steer your business toward even more success.

Tip #7: Diversify

Diversifying your product range is akin to not putting all your eggs in one basket. It helps balance your cash flow when one product or group of products is going through a period of slow sales but also makes for a generally more robust business model.

But diversification isn’t just about broadening your product range. Your sales and marketing channels play their part here. If you’re relying solely on Amazon for your sales, consider exploring other platforms like eBay, Etsy, or even your own eCommerce Shopify website to reach a wider audience, increase your sales, and protect your business against issues like algorithm changes in any one platform.

Similarly, diversifying your marketing channels can help you attract more customers and boost your sales. If you’re only using pay-per-click advertising, consider exploring other marketing strategies like content marketing, social media marketing, or email marketing.

Remember, diversification is all about spreading your risks and seizing more opportunities. By diversifying your products, sales channels, and marketing strategies, you can improve your cash flow and set your business up for long-term success.

Tip #8: Cut Unnecessary Expenses

The final strategy to improve your cash flow as an Amazon seller is to cut unnecessary expenses. This is one of the quickest and most effective ways to improve your cash flow that you can take away and action right now.

Take a close look at your business expenses. Are there software subscriptions you’re not using anymore? Are you taking unnecessary business trips? Are there any services that you’re paying for but not getting the full value from?

A study by Nexthink across 6 million customers of 30 popular business SaaS products found that those customers were wasting $45 million Every. Single. Month. On unused software.

Don’t fall into the trap of subscribing and forgetting. By regularly reviewing your outgoing expenses, you can identify any unnecessary costs and eliminate them – saving your business potentially hundreds or even thousands of dollars every year and improving your overall cash flow.

Remember, every dollar saved is a dollar earned.

Ready to Start Taking Action?

While some tips can start improving your cash flow immediately, others require some more thought. One tip that may seem like work but can actually start working for you right away?

Securing pay-as-you-sell insurance.

Get your free quote from Assureful today – in just a few clicks. By connecting your Amazon seller account, our AI engine collects all the data we need without boring, lengthy forms that you simply don’t have time for.

Boost your cash flow with monthly premiums starting from just $26/month.

No obligation quote.

Policies can be canceled at any time, with 30 days’ notice.

For more Amazon tips, check out our articles on:

- Amazon COI – what is it and how do I upload it

- Amazon global selling – how to effectively expand into international sales

- How to renew your Amazon FBA insurance and get the best quote

- How to add a variation to an existing product

- Calculating Amazon FBA profit accurately

- Amazon Brand Registry Guide – protect and scale your business

- How to get Amazon Seller Badges

0 Comments